At the grand opening of Bitcoin 2025 held in Las Vegas on May 27, U.S. crypto-friendly Senator Cynthia Lummis publicly stated that President Trump strongly supports the Bitcoin bill known as the BITCOIN Act, and plans to purchase 1 million BTC over the next five years. She also revealed that the White House is currently advancing several major legislative initiatives involving stablecoins, digital asset market structure, and a Bitcoin strategic reserve. These bills are expected to roll out in the coming weeks and will become focal points in global crypto policy discussions.

Trump Backs Bitcoin Bill, Plans to Acquire 1 Million BTC in 5 Years

Speaking at the Bitcoin 2025 conference in Las Vegas, Senator Cynthia Lummis announced that she will reintroduce the BITCOIN Act and emphasized that President Trump is fully backing the bill.

She also disclosed two key points of the proposal:

- The U.S. government plans to purchase nearly 1 million BTC over the next five years.

- Lummis assured that the funding will come from the existing budgets of the Federal Reserve and the Treasury Department, with no additional burden on taxpayers.

White House Expert Team Assembled, Stablecoin Legislation Ready for Vote

Lummis further revealed that the White House has already formed a professional team working on three major digital asset bills:

- Stablecoin Legislation

- Market Structure Bill for Digital Assets

- Bitcoin Strategic Reserve Bill

She stated that these three bills will be introduced in the order listed. The most advanced among them is the stablecoin bill, known as the GENIUS Act, which has already been submitted to the Senate Banking Committee.

GENIUS Act and BITCOIN Act to Strengthen U.S. Leadership in Crypto Assets

The GENIUS Act aims to establish a regulatory framework for compliant, redeemable “payment stablecoins” designed for daily transactions and corporate use, clearly distinguishing them from high-risk decentralized or algorithmic stablecoins.

White House “AI & Crypto Czar” David Sacks previously stated in an interview:

“The GENIUS Act will definitely pass, and it has bipartisan support.”

He emphasized that clear regulatory guidelines could rapidly generate trillions of dollars in demand for U.S. Treasuries.

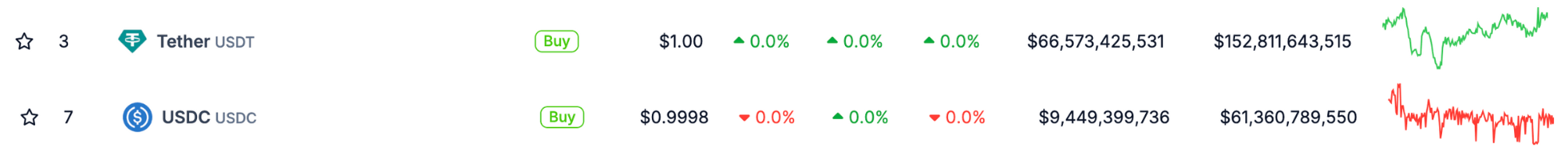

According to data from CoinGecko, the total market capitalization of major stablecoins USDT and USDC currently stands at $214.1 billion. These stablecoins are pegged to the U.S. dollar and backed by U.S. Treasuries, further reinforcing the dollar’s position as the global settlement currency.

Conclusion

Recent policy signals from the U.S. clearly indicate a strategy to strengthen the dollar’s global dominance by establishing a strategic Bitcoin reserve and introducing compliant stablecoin legislation.