ChatGPT’s Bitcoin analysis shows that the Bitcoin price is consolidating at the historic $117,208 level, down slightly by 0.92% , as Treasury Secretary Scott Bessant clarified that the United States will seek budget-neutral Bitcoin acquisitions rather than direct purchases for strategic reserves.

Meanwhile, despite testing the 20-day EMA resistance at $117,499, Bitcoin is holding a bullish structure above the key 50-day ( $114,797 ), 100-day ( $ 109,975 ), and 200-day ( $102,522 ) EMAs, setting the stage for a potential correction or deeper correction.

ChatGPT’s Bitcoin analysis combines 19 real-time technical indicators to assess BTC’s trajectory during the period of Treasury policy clarification and consolidation at all-time highs around $117,000 .

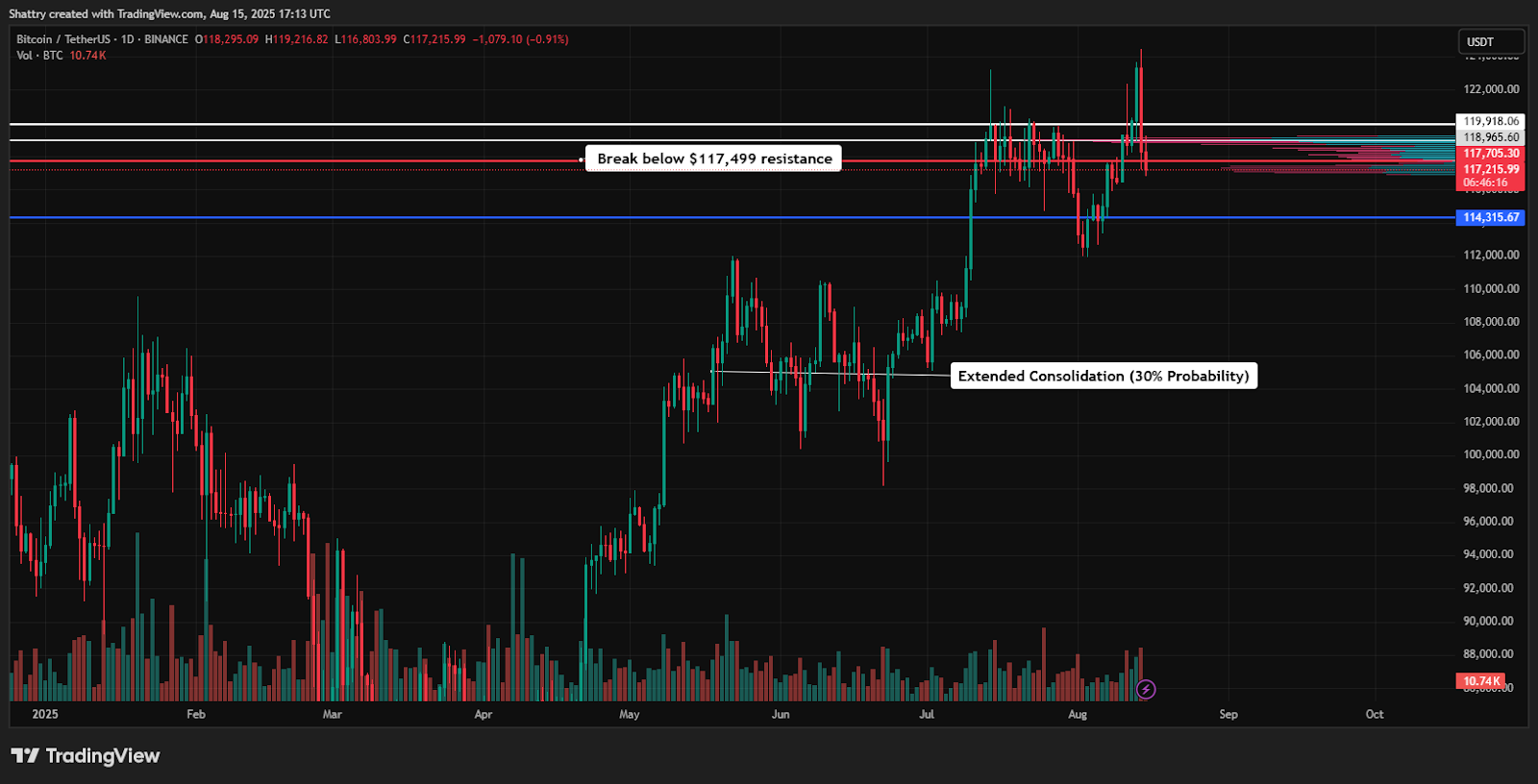

Technical analysis: Consolidation at historical levels testing key resistance

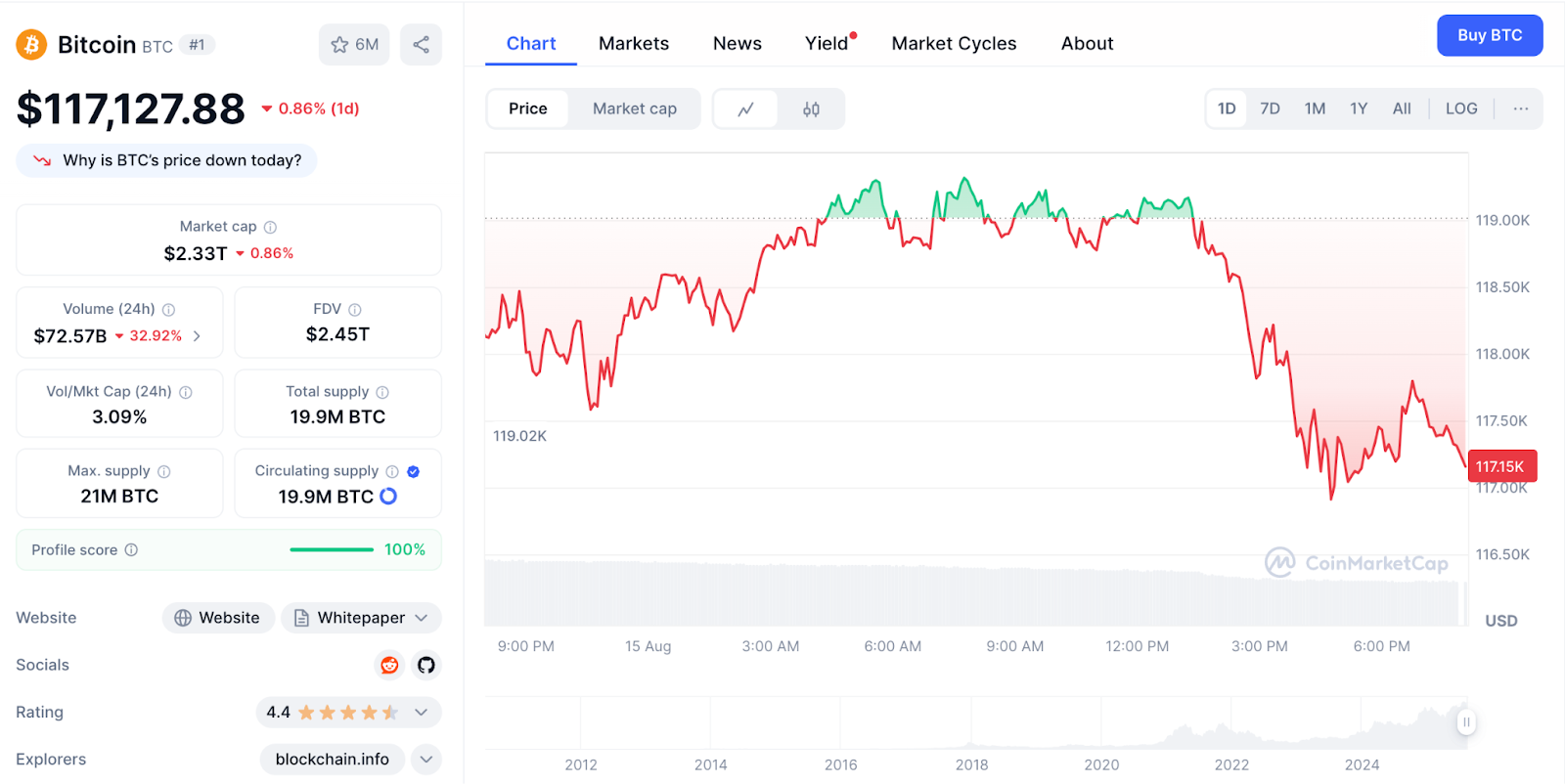

Bitcoin is currently trading at $117,208.67 , down 0.92% from its opening price of $118,295.09 . The price has been trading in a narrow range between $119,216.82 (high) and $116,827.29 (low). The intraday volatility of 2.0% reflects the controlled volatility typical of institutional positions.

The RSI is at 50.61 , which is completely neutral and provides balanced momentum with no oversold or overbought conditions.

The moving averages indicate strong bullish momentum, with Bitcoin trading 2.1% above the 50-day EMA at $114,797 , 6.2% above the 100-day EMA at $109,975 , and 12.5% above the 200-day EMA at $102,522 .

The MACD shows exceptionally strong bullish momentum at 135.68, well above zero, with the signal line at 1,067.32 and the positive histogram at 931.64 .

This momentum strength during price consolidation often precedes a major breakout move, as technical indicators remain bullish despite the sideways price movement.

Volume analysis shows unusually low trading activity at 9.87K BTC, indicating reduced retail participation while institutional investors prepare for the next major move.

The ATR presents a volatility paradox at 105,232.55 , showing that despite the current price stability, there is still significant potential.

Market Background: Fiscal policy clarification triggers cautious reaction

Bitcoin showed resilience in August after U.S. Treasury Secretary Scott Bessant clarified that U.S. Bitcoin acquisitions will not impact the budget and will not be direct government purchases.

The measured reaction of -0.92% reflects institutions’ maturity in processing policy nuances rather than panic selling.

The 2025 trend shows significant progress, from a January opening price of $93,576 to the current level of $117,000 , with strong volatility, including a drop to $78,258 in February and a peak near $119,447 in July .

Current positioning represents healthy consolidation within this historic bull market.

The current price maintains a 5.12% discount to the all-time high of $124,457 on August 14th , while ensuring an extraordinary gain from the historical low.

Bitcoin’s proximity to recent peaks suggests resilience despite policy uncertainty and broader market liquidations that have impacted other cryptocurrencies.

Market fundamentals: Strong indicators support historical levels

Despite a slight drop of 0.85%, Bitcoin still maintains its position as the leading cryptocurrency with a market capitalization of $2.33 trillion .

The stabilization in market capitalization was accompanied by a $75.25 billion ( -29.7% ) decrease in trading volume , indicating that the market was consolidating rather than diverging as institutional participants awaited clarity on direction.

The volume-to-market cap ratio of 3.23% indicates trading activity that is historically typical of a consolidation phase.

The circulating supply of 19.9 million BTC represents 94.8% of the token’s maximum supply of 21 million , and this close scarcity supports long-term value dynamics.

A market dominance of 58.86% ( +1.08% ) demonstrates Bitcoin’s strength relative to altcoins during times of market uncertainty.

The fully diluted valuation of $2.45 trillion reflects the total network value at current pricing, while the controlled supply mechanism continues to support institutional confidence.

Technical fundamentals show that Bitcoin is trading 240,564,075% above its 2010 low of $0.04865 and has proven to be resilient with over 15 years of holding its value.

Social sentiment: mixed signs amid policy uncertainty

LunarCrush data shows that during the Treasury Department’s policy clarification, Bitcoin’s AltRank dropped to 292 , indicating cautious social activity. Its Galaxy score was 38, reflecting a temporary cooling of sentiment as participants digested the changes in the government’s Bitcoin acquisition strategy.

Engagement metrics show high activity, and although engagement has decreased, total engagement still reached 101.05 million times and the number of mentions was 291.1K times ( +108.02K ).

Recent social themes have focused on institutional buying, with Brevan Howard revealing he holds $2.3 billion worth of Bitcoin, and reports indicating that demand for increased holdings has reached historic levels.

Despite short-term policy noise, community discussion centers on support for defense, breakthrough potential, and long-term institutional adoption.

Significant developments also include Jack Dorsey’s continued advocacy for Bitcoin and ETF speculation momentum.

Overall, the social analysis suggests that, although retail involvement decreased during the consolidation phase, institutional positioning continued.

Bitcoin Analysis by ChatGPT: Support Structure Remains Well

Bitcoin analysis on ChatGPT shows that there is an excellent support layer below current levels, namely today’s low around $116,827 , followed by key support at the 50-day EMA ( $114,797 ).

The 100- day EMA at $109,975 provides major support and has strong institutional significance.

The key resistance is seen at the 20-day EMA around $117,499 , which is a major hurdle for the bullish momentum to continue.

A breakout of this level could trigger momentum towards the $119,000– $ 121,000 target, while a failure could lead to a test of the $114,000– $110,000 support area.

The technical setup suggests that the Coiled Spring pattern with low volume, neutral RSI and extremely strong MACD momentum creates ideal conditions for a significant directional move.

Historical patterns suggest that such consolidation phases typically resolve with large swings consistent with extreme ATR potential.

Bitcoin three-month price prediction: Breakout scenario

Bullish breakout (50% probability)

A successful breakout above the $117,499 resistance level, coupled with continued institutional adoption, could propel Bitcoin prices to $ 119,000- $125,000 , a 2 % to 7% increase from current levels .

This situation requires quantitative confirmation and fiscal policy stabilization.

Extended Merger (30% chance)

The ongoing range-trading between $114,000 and $119,000 allowed technical indicators to reset while institutional positioning continued.

This situation provides an accumulation opportunity close to the support level.

Calibration test (20% chance)

A break below the $114,797 support could trigger a sell-off towards the main support level of $ 119,975 – $110,000 , which would imply a drop of 6-7 % before a potential recovery accelerates .

Bitcoin Analysis by ChatGPT: Historic Consolidation Signals a Major Move

ChatGPT’s Bitcoin analysis shows that Bitcoin is at a critical inflection point between fiscal policy clarity and the potential for a technological breakthrough.

Consolidation at the $117,000 level and extremely strong MACD momentum suggest that institutions are ready for a major directional move.

Next price target: $119,000 to $125,000 within 90 days

The current trend needs to decisively break through the resistance level of $117,499 to verify whether the bullish momentum can continue towards the psychological level of $119,000 .

From there, continued institutional adoption could propel Bitcoin towards $125,000 + historical resistance, representing meaningful breakout potential.

However, failure to hold support at $116,827 would imply a deeper correction to the $114,000 to $110,000 range, creating the best accumulation opportunity before the next institutional wave propels Bitcoin towards cycle highs above $125,000 .

bitany Hong Kong USDT exchange shop, focusing on cryptocurrency exchange services