Jeremy Allaire, CEO of stablecoin issuer Circle, stated in an interview with Bloomberg that all stablecoin issuers should be registered in the United States, seemingly hinting at regulatory concerns regarding its competitor, Tether. Additionally, the market cap of USDC has reached new highs, and Circle, which aims to comply with U.S. regulations and go public through an IPO, may soon achieve this goal.

Circle CEO: Stablecoin Issuers Should Be Registered in the U.S.

Jeremy Allaire, CEO of stablecoin issuer Circle, stated in an interview with Bloomberg that issuers of U.S. dollar-based cryptocurrencies (i.e., stablecoin issuers) should be registered in the United States.

“This shouldn’t be a free pass, right? Can you just ignore U.S. laws, do whatever you want anywhere, and sell your product to the U.S.?” Allaire emphasized that this issue concerns consumer protection and financial integrity. Whether it’s an offshore company or one headquartered in Hong Kong, if they want to offer U.S. dollar stablecoins in the U.S., they must be registered in the U.S., just as we must register in other places.

Recently, the U.S. has introduced two stablecoin bills that will impact the $230 billion stablecoin market. These legislative efforts are expected to be among the first actions considered by the second term of President Trump’s administration, with Trump vowing to make the U.S. the global capital of cryptocurrency.

Allaire stated: “The stablecoin bill is a top priority for the government.”

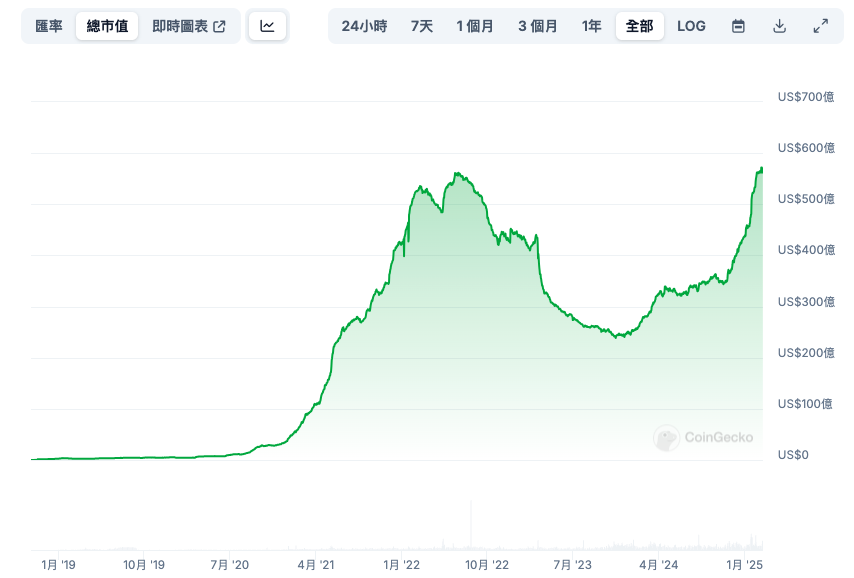

Circle Hits New Market Cap High

The market cap of USDC dropped to $24.5 billion in 2023 due to the collapse of Silicon Valley Bank, but it reached $56.2 billion last Friday. Compared to market leader Tether’s USDT, Circle’s USDC took longer to recover its lost value. Currently, USDT has a market cap of $142.1 billion, more than twice that of USDC.

Circle Pushes for U.S. IPO, Tether Unfazed

In Q4 of 2021, Circle attempted to go public through a merger with the special purpose acquisition company (SPAC) Concord Acquisition Corp, but ultimately announced the termination of the IPO plan by the end of 2022.

However, as stablecoin usage has become more diversified and countries are increasingly calling for regulation, Circle seems determined to seize the cryptocurrency market’s recovery. Early last year, it quietly applied for a U.S. IPO, hoping to become the first compliant and publicly listed stablecoin issuer in the U.S.

In contrast, Tether, after the European MiCA regulations came into effect, has not sought compliance in Europe. Instead, it abandoned its Euro-pegged stablecoin EURt and opted to invest in other compliant stablecoins, EURQ and USDQ, to indirectly engage with the European market. Tether currently seems focused on developing countries and has no intention of registering in the U.S. Earlier, JPMorgan stated that the proposed U.S. stablecoin bill, which is expected to be released later this year, may pose a “greater” challenge to Tether.