The United States has introduced two stablecoin bills, which will impact the $230 billion stablecoin market. JPMorgan released a report stating that according to the latest bill, the largest stablecoin issuer, Tether, has only 66%-83% of its reserves in compliance. While Tether CEO Paolo Ardoino has retorted that JPMorgan issued the report because it missed the Bitcoin train, Tether has already delisted EURt in Europe due to MiCA regulations. With Circle rising to the challenge, could Tether give up the massive U.S. market?

JPMorgan Questions Tether’s Insufficient Reserves

The U.S. has proposed two stablecoin bills, the House’s STABLE Act and the Senate’s GENIUS Act, aimed at regulating stablecoin issuers through licensing requirements, risk management rules, and 1:1 reserve backing.

According to a report by The Block, JPMorgan analyst Nikolaos Panigirtzoglou wrote in a report on Wednesday that under the STABLE Act, only 66% of Tether’s reserves are compliant, while under the GENIUS Act, only 83% of Tether’s reserves meet the required standards. The analyst noted that these figures indicate that as stablecoin supply has surged, Tether’s compliance rate has been declining since mid-2024.

GENIUS Act’s Strict Requirements Could Lead to Major Adjustments for Stablecoin Issuers

The STABLE Act enforces stricter reserve requirements and allows state-level regulation, while the GENIUS Act calls for federal oversight of large issuers and allows for a broader range of reserve assets. Analysts say that if either bill passes, Tether will need to restructure its reserves and move assets into U.S. Treasuries and other liquid assets.

Looking at Tether’s latest quarterly data for 2024, as of December 31, 2024, the group’s total assets amounted to $143.7 billion, with total liabilities at $136.6 billion.

In terms of asset reserves, 82.35% is held in cash, cash equivalents, and other short-term deposits. Among these, Tether directly and indirectly holds $113 billion in U.S. Treasuries. Tether also holds $7.86 billion in Bitcoin and $5.32 billion in precious metals (i.e., gold).

According to JPMorgan’s report, 82.35% of Tether’s assets—cash, cash equivalents, and short-term deposits—could qualify as compliant reserves under the GENIUS Act. However, the STABLE Act might exclude other options besides U.S. Treasuries, which could mean that even money market funds and repurchase agreements would not qualify. These conditions are extremely strict. By these standards, even Circle, which emphasizes compliance and seeks a U.S. IPO, may need to make adjustments!

Tether Focuses on Indirect Participation in Europe, But Faces Bigger Challenges in the U.S.

Tether controls nearly 60% of the stablecoin market and is already under regulatory scrutiny in Europe. The MiCA regulations in Europe require large issuers to hold 60% of their reserves in EU bank deposits. Analysts say this has led to Tether delisting from several European exchanges, though its limited market share in the region has minimized the impact.

In contrast, analysts note that since Tether has a larger market share in the U.S., regulatory challenges in the U.S. are more significant. Both proposed bills require high-quality, highly liquid assets as reserves, which could pressure Tether’s dominant position in the U.S. market.

CEO Ardoino Responds, Criticizes JPMorgan for Missing the Bitcoin Train

In response, Tether CEO Paolo Ardoino countered, remarking that JPMorgan’s frustration stemmed from missing the Bitcoin train.

“Despite much still needing to be determined in the ongoing bill discussions, even in the most extreme scenario, JPMorgan overlooks a key fact: Tether’s group equity (on top of stablecoin reserves) holds over $20 billion in other highly liquid assets and generates more than $1.2 billion in quarterly profits through U.S. Treasuries. This doesn’t even include profits from other investments and activities. Tether likely has the best risk management in the industry. JPMorgan is frustrated because they missed the Bitcoin train.”

Circle Rising to the Challenge, Does Tether Have a Chance to Comply in the U.S.?

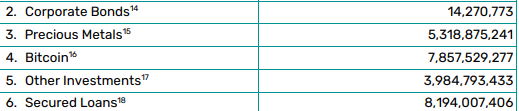

Looking at Tether’s latest attestation report, even with the relatively lenient GENIUS Act, Tether still needs to address several assets, including $14.27 million in corporate bonds, $5.3 billion in gold, $7.86 billion in Bitcoin, $3.98 billion in other investments, and $8.19 billion in collateralized securities. Even after deducting the excess reserves of $7.09 billion, around $18.2 billion in assets would still be non-compliant.

As for whether these assets are truly as liquid as CEO Paolo Ardoino claims? Only gold and Bitcoin seem to be sufficiently liquid. This suggests that JPMorgan believes Tether may need to sell gold or Bitcoin and convert them into U.S. Treasuries, which seems reasonable.

JPMorgan analysts also stated that the proposed bills are expected to be finalized later this year and may pose “more significant” challenges for Tether. After all, while Tether can afford to abandon the smaller market for the EURt stablecoin in Europe, the U.S. dollar stablecoin USDT is a key revenue source for Tether, and it is unlikely to give it up. The market cap of USDT has reached $141.9 billion, accounting for 61% of the total stablecoin market of $230.5 billion. Circle’s USDC, with a market cap of $56.1 billion, is closely following. Circle’s market cap has grown from $28.1 billion in March last year, buoyed by its MiCA compliance in Europe, and its market share is steadily rising. It looks like as stablecoin legislation accelerates in the U.S., Tether will face a tough battle ahead.