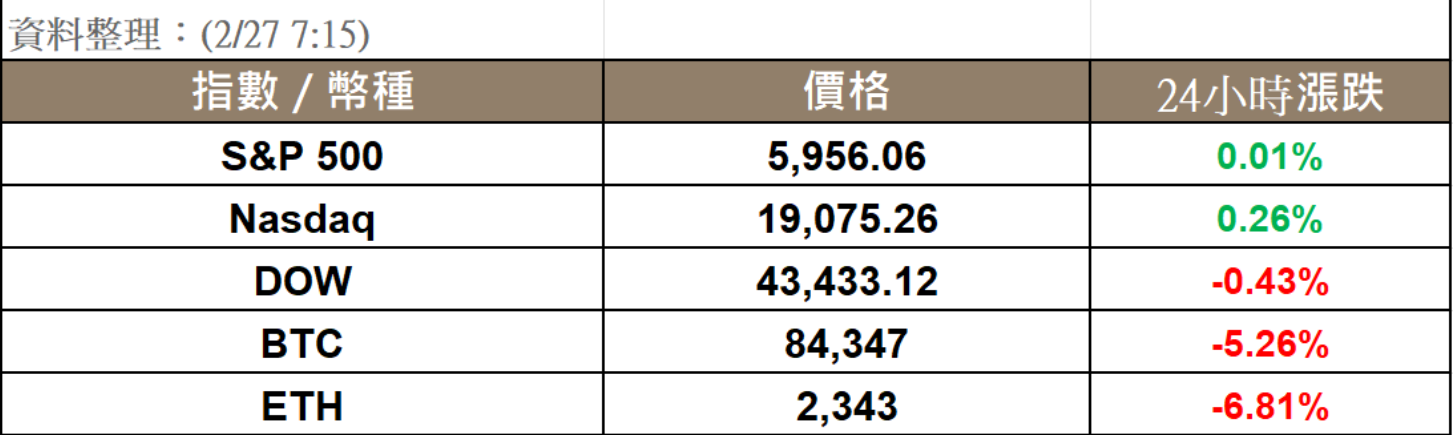

Yesterday, the major US stock indices had mixed results. Nvidia (NVDA) reported Q4 earnings after market hours that exceeded Wall Street expectations, causing its stock to rise in pre-market trading and driving a rebound in tech stocks, particularly the Nasdaq. However, the crypto market continued its decline, with Bitcoin falling as low as $82,256. Even Strategy (formerly MicroStrategy) founder Michael Saylor joked that he might need to take a second job to accumulate more Bitcoin. However, Strategy’s stock, MSTR, rose over 5% yesterday, closing at $263.27, breaking away from Bitcoin’s movements.

Tariff Worries and Economic Slowdown Continue to Dominate Market Sentiment

President Donald Trump’s comments about US trade policies have raised concerns about economic growth. At his first cabinet meeting on Wednesday, Trump promised that tariffs on the US’s top three trade partners, Canada and Mexico, would go into effect after a one-month suspension. He also promised to soon expand the tariffs to include 25% duties on goods from the European Union.

Housing data released on Wednesday showed that new home sales in January dropped by 10.5% to 657,000, far below economists’ forecast of 671,000, and lower than the upward-revised 734,000 in December.

The focus for this week is the PCE index, set to be released on Friday by the Federal Reserve. The PCE is the Fed’s preferred inflation gauge and will provide clues for future monetary policy decisions and interest rate cuts.

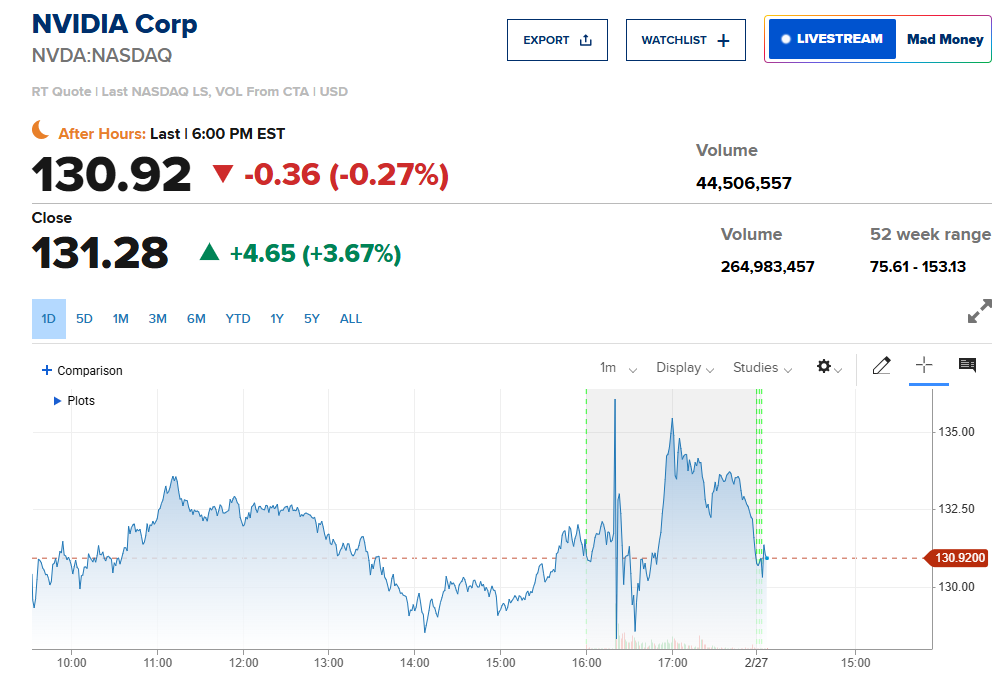

Nvidia Earnings Exceed Expectations

AI leader Nvidia (NVDA) reported Q4 earnings after market hours on Wednesday that exceeded Wall Street’s expectations. The company also provided strong guidance for the next quarter. The company’s report and outlook suggest that the chipmaker is confident it will continue its historic growth driven by artificial intelligence through 2025.

Investors bet on the positive results ahead of the earnings report, with Nvidia leading a rise of over 3% yesterday. The chip giant, seen as a barometer for AI, expressed optimism about its much-anticipated Blackwell product line, which brought in $11 billion in revenue. Nvidia described it as the “fastest product growth” in its history. This outlook comes during a turbulent period for the AI industry, with concerns over whether data center operators will slow down spending.

However, after the earnings report was released, the stock showed volatility, and investors seemed to be digesting Nvidia’s outlook and the future of AI development.

Bitcoin Drops to $82K, Strategy Stock Rebounds 5%

The crypto market did not follow the tech stock rebound. Bitcoin hovered around $88K for several hours before falling again, reaching a low of $82,256. Even Michael Saylor, founder of Strategy (formerly MicroStrategy), joked about considering a second job to acquire more Bitcoin. However, Strategy’s stock, MSTR, rose over 5% yesterday, closing at $263.27, detaching from Bitcoin’s movements.

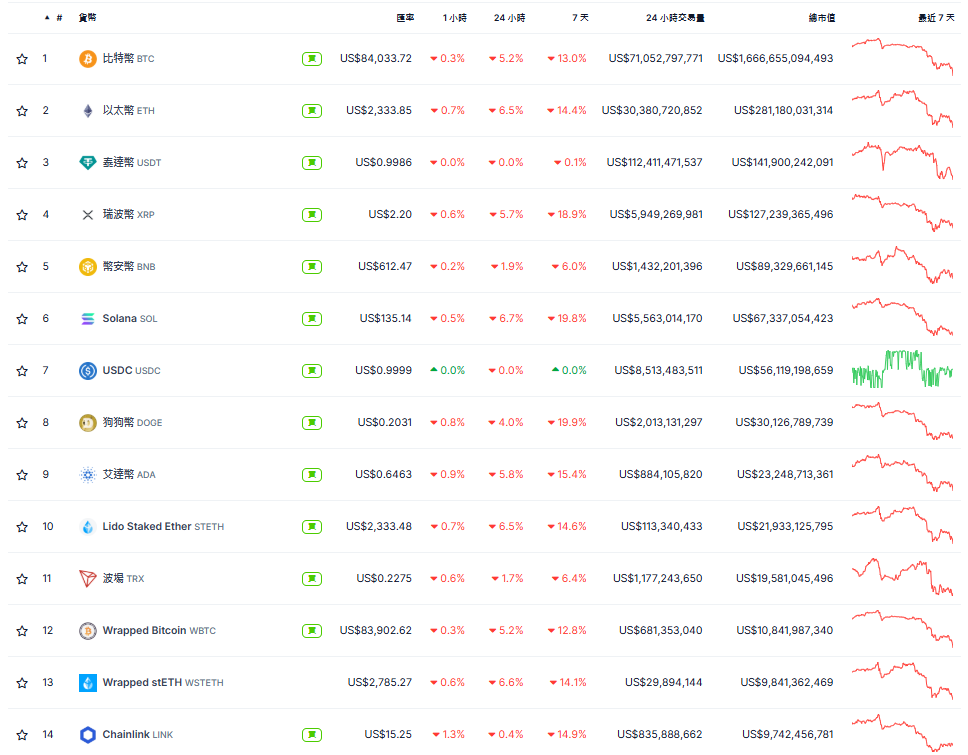

The top 10 cryptocurrencies by market cap continued to fall yesterday, with BNB, TRX, and LINK showing relative resilience, while the other coins experienced declines of over 4%.