Hackers Successfully Launder Funds: Bybit’s 499,000 ETH Completely Vanishes

The recent hack of the renowned cryptocurrency exchange Bybit has once again drawn market attention. According to blockchain observer Ember (@EmberCN), the hackers successfully laundered the 499,000 ETH (approximately $1.39 billion) stolen from Bybit within 10 days, leaving almost no trace.

The hackers’ large-scale money laundering operation not only impacted market sentiment but may also be one of the key factors behind ETH’s recent price drop of 23% (from 2,780to2,780to2,130).

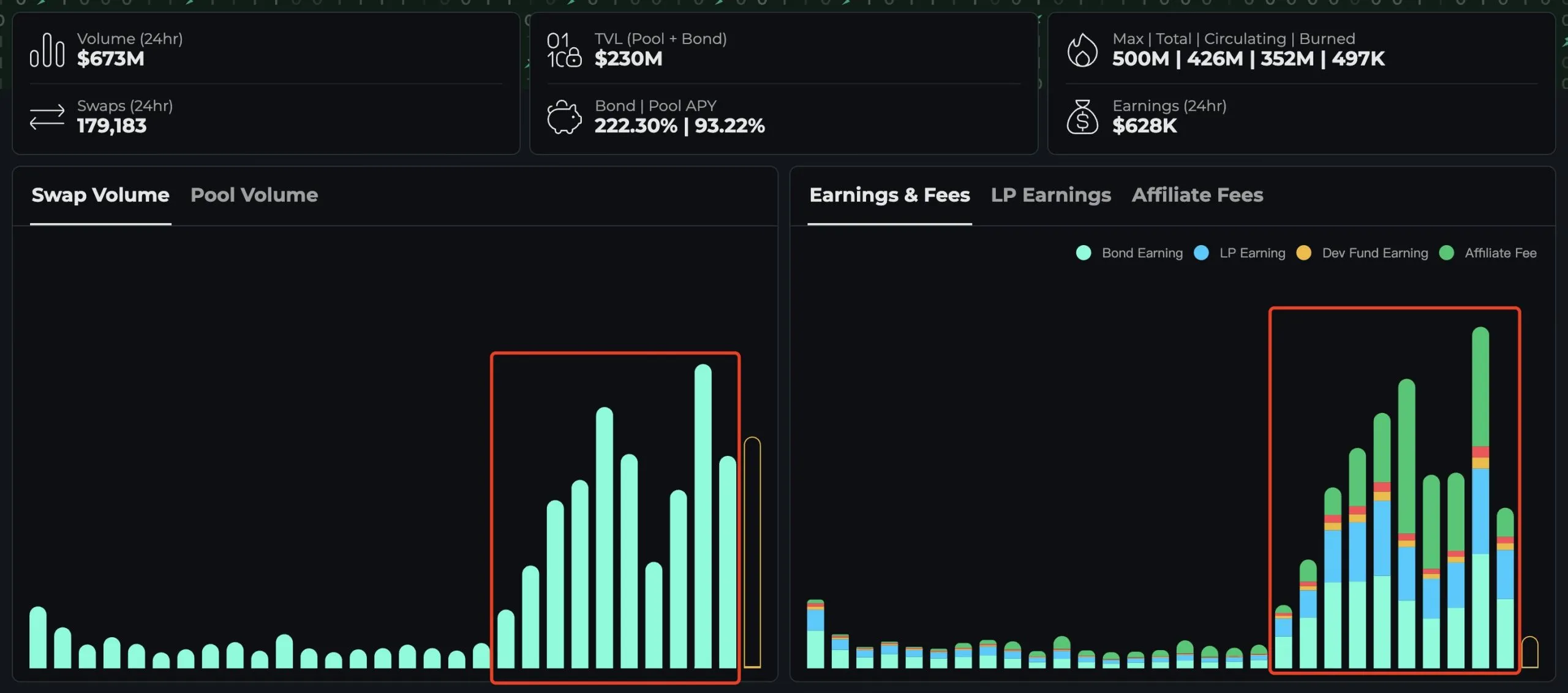

Hackers Primarily Use THORChain for Money Laundering, Transaction Volume Surges

Ember noted that the primary channel for the hackers’ money laundering was THORChain. Due to the hackers’ extensive use of this protocol for fund transfers, THORChain’s transaction volume surged by 5.9billion,generating5.9billion,generating5.5 million in fee revenue.

THORChain’s decentralized nature makes it a popular choice for fund transfers, but it has also sparked discussions within the community about whether it has become a “money laundering tool” for hackers.

ETH Flows into Bitcoin Ecosystem, Money Laundering Process Becomes More Complex

Blockchain security expert Cos (@evilcos) further pointed out that, aside from some funds being recovered, most of the stolen ETH has left the Ethereum ecosystem and entered the Bitcoin ecosystem. On the Bitcoin chain, hackers will employ a more complex UTXO model for money laundering, significantly increasing the difficulty of tracking.

Notably, THORChain’s node operators have reaped substantial profits from these large-scale transactions.

eXch Maintains Mysterious Stance, Regulatory Pressure Mounts

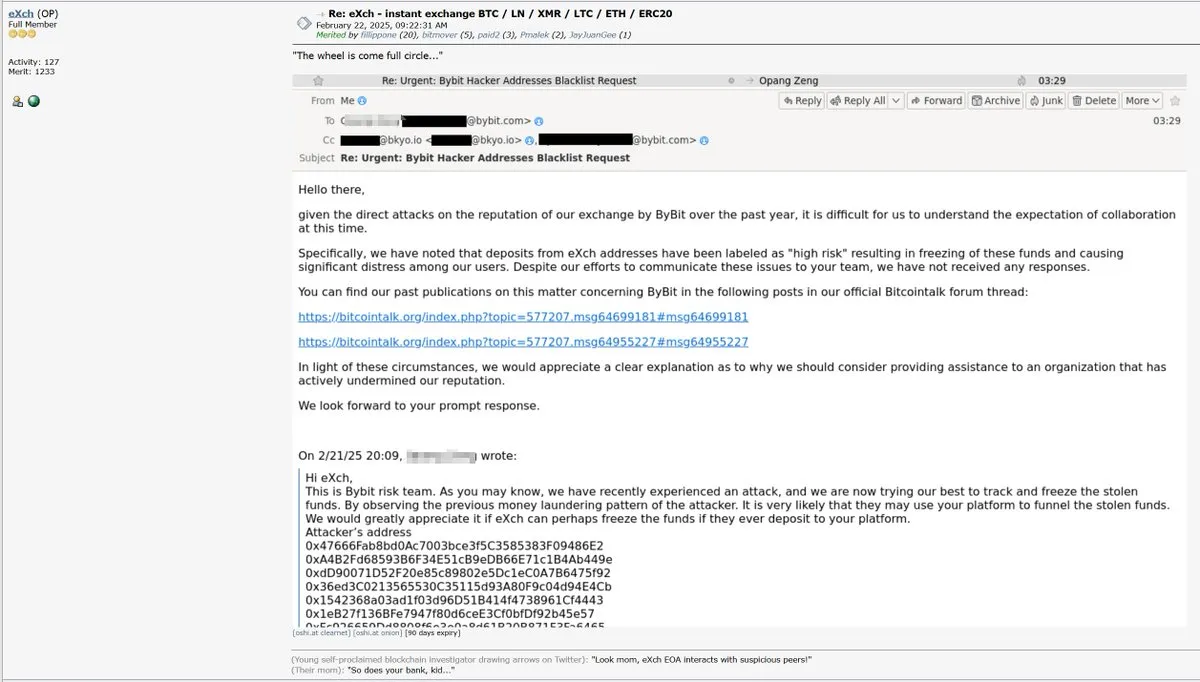

Additionally, Cos mentioned eXch, a KYC-free token exchange platform that has previously drawn attention for its involvement in money laundering activities. Despite the widespread discussion surrounding this incident, eXch continues to maintain its “business as usual” attitude. Bybit attempted to contact eXch to assist in freezing assets, but eXch responded:

“Given Bybit’s direct attacks on our exchange’s reputation over the past year, we find it difficult to understand the expectations for cooperation. Specifically, we have noticed that deposits from eXch addresses were flagged as ‘high risk,’ leading to frozen funds and significant distress for our users. Despite raising these issues with your team multiple times, we have yet to receive any response.”

As hackers increasingly exploit decentralized protocols for money laundering, regulatory pressure is gradually mounting. Whether the DeFi sector will face stricter regulatory measures in the future remains a topic of close attention.