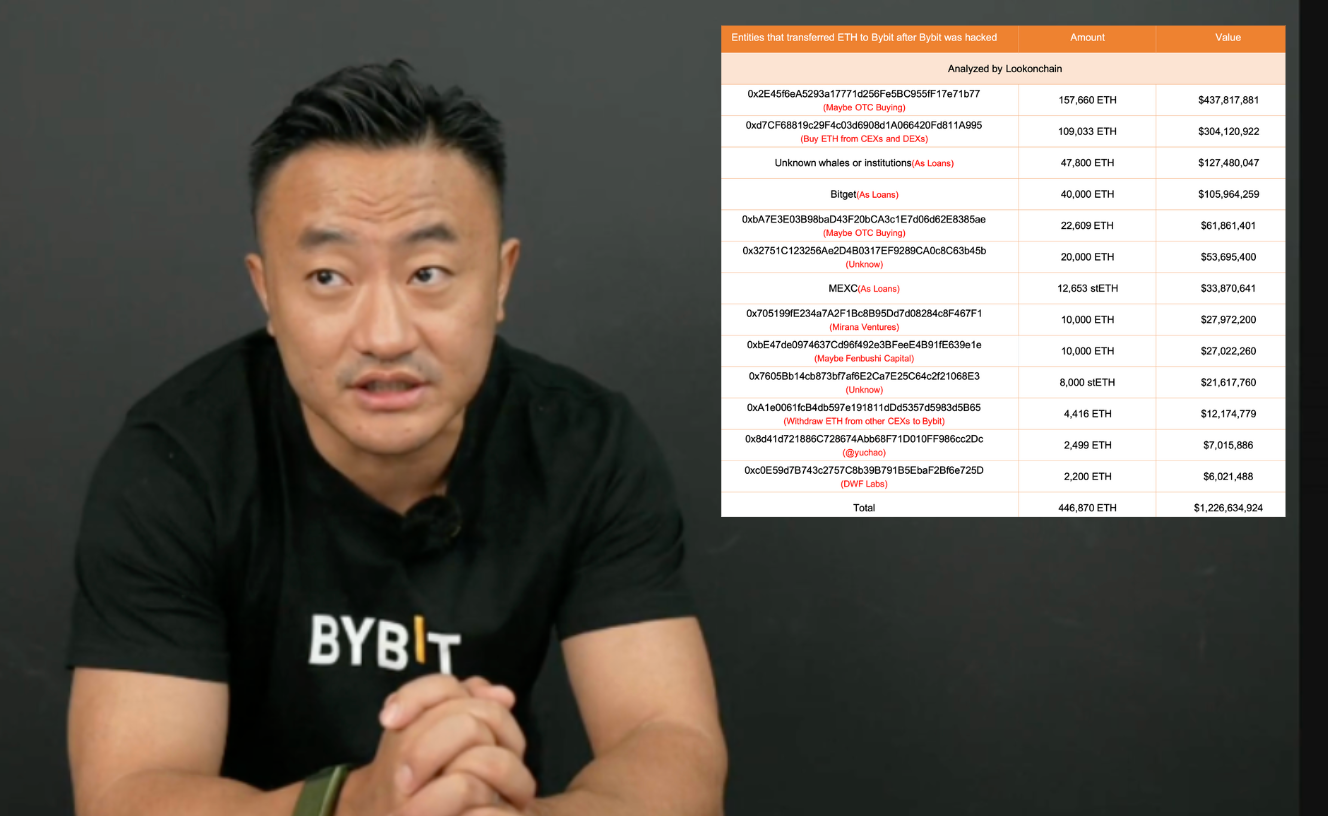

Renowned cryptocurrency exchange Bybit recently suffered a hack resulting in the loss of 1.5billionincryptoassets.Subsequently,asignificantamountofEthereum(ETH)wastransferredintoBybit,drawingintensemarketattention.Accordingtoon−chaindataplatformLookonchain,approximately446,870ETH,wortharound1.5billionincryptoassets.Subsequently,asignificantamountofEthereum(ETH)wastransferredintoBybit,drawingintensemarketattention.Accordingtoon−chaindataplatformLookonchain,approximately446,870ETH,wortharound1.226 billion, flowed into Bybit after the hack. The funds originated from various sources, including over-the-counter (OTC) transactions, institutional loans, and exchange withdrawals, indicating that market participants still maintain strong confidence in Bybit. Bybit CEO Ben Zhou has assured users that the company will rebuild trust through transparent management and stricter security reviews.

Analysis of ETH Inflows: Largest Single Transaction of 157,000 ETH

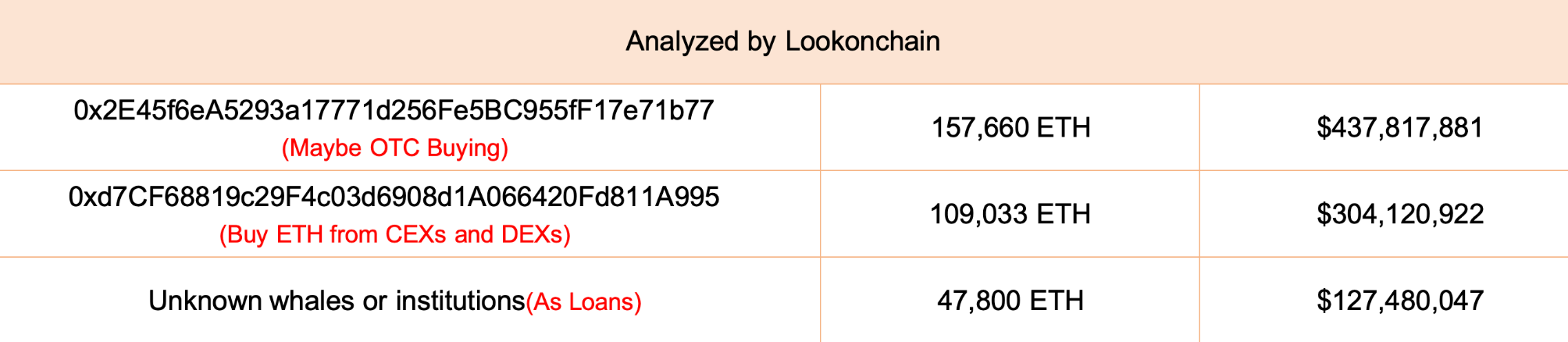

Data reveals that the largest ETH inflow transaction came from the address 0x2E45f6eA5293a17771d256Fe5BC955fF17e71b77, which transferred approximately 157,660 ETH, worth around $437 million, likely purchased through OTC transactions.

Another significant transfer originated from the address 0x7DCF68819c29F4c03d6908d1A066420Fd811A995, involving approximately 109,033 ETH, worth around $304 million, possibly acquired through centralized exchanges (CEX) and decentralized exchanges (DEX).

Additionally, loans from unnamed institutions or whale wallets accounted for a notable portion, with around 47,800 ETH, worth approximately $127 million, indicating that institutions are still supporting Bybit through lending.

Exchanges and Institutions Step In, Loans Dominate

Several well-known institutions and exchanges participated in this wave of ETH inflows, including:

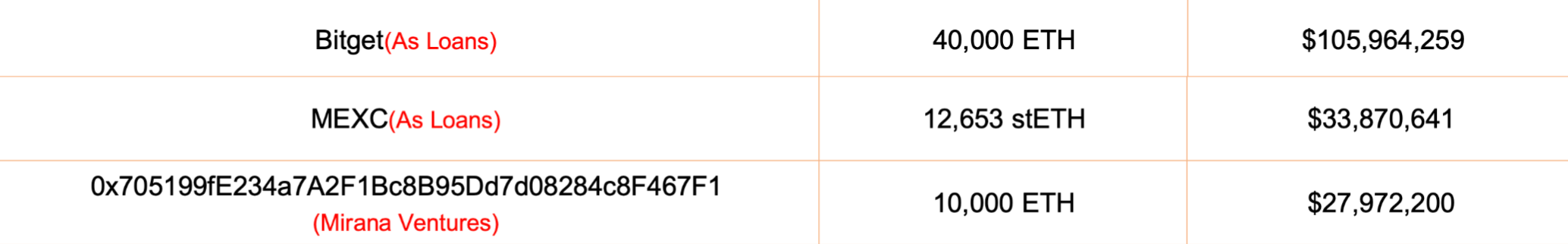

- Bitget: Provided a loan of approximately 40,000 ETH, worth around $105 million.

- MEXC: Provided a loan of approximately 12,653 stETH, worth around $33.87 million.

- Mirana Ventures: Transferred approximately 10,000 ETH, worth around $27.97 million.

The involvement of these institutions reflects the market’s confidence in Bybit’s short-term liquidity situation.

Some Funds Likely from Investment Funds and Individuals

Some of the funds are speculated to have come from venture capital or individual investors:

- Twitter user @yuchao’s related address transferred approximately 2,499 ETH, worth around $7.01 million.

- DWF Labs transferred approximately 2,200 ETH, worth around $6.02 million.

- Fenbushi Capital transferred approximately 10,000 ETH, worth around $27.02 million.

OTC Transactions and Unknown Fund Sources Still Under Observation

Some ETH inflows remain unclear in origin:

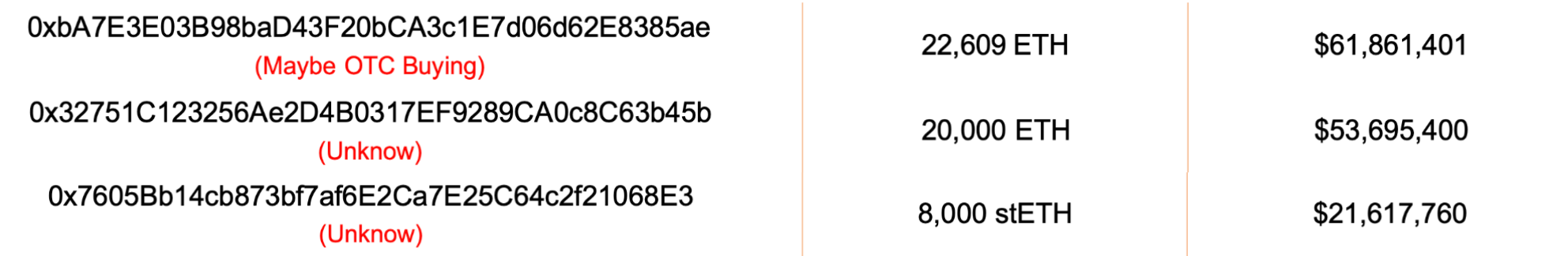

- Address 0xbA7E3E03B98baD43F20bCA3c1E7d06d62E8385ae transferred approximately 22,609 ETH, worth around $61.86 million, possibly from OTC transactions.

- Address 0x32751C123256Ae2D4B0317EF9289CA0c8C63b45b transferred approximately 20,000 ETH, worth around $53.69 million, source unknown.

- Address 0x7605Bb14cb873b7af6E2CA7E256C4c2f21068E3 transferred approximately 8,000 stETH, worth around $21.61 million, source unknown.

Fund Inflows Show Market Confidence in Bybit Remains

Although the Bybit hack has raised market concerns, on-chain data indicates that institutions, exchanges, and investors are still willing to provide liquidity support, suggesting that market trust in Bybit has not been shattered. However, some fund sources remain questionable, particularly OTC transactions and unknown entities. How this will impact market dynamics in the future remains to be seen.