Google Cloud is entering the blockchain infrastructure space with the development of its first layer platform, the Google Cloud Common Ledger (GCUL). Designed for financial institutions, the system supports tokenized assets, settlements, and Python-based smart contracts.

The initiative, currently running on a private testnet, debuted in March of this year through a joint pilot with CME Group. The two companies announced plans to pilot tokenization and wholesale payments on a distributed ledger, though they didn’t label it a layer-1 blockchain at the time.

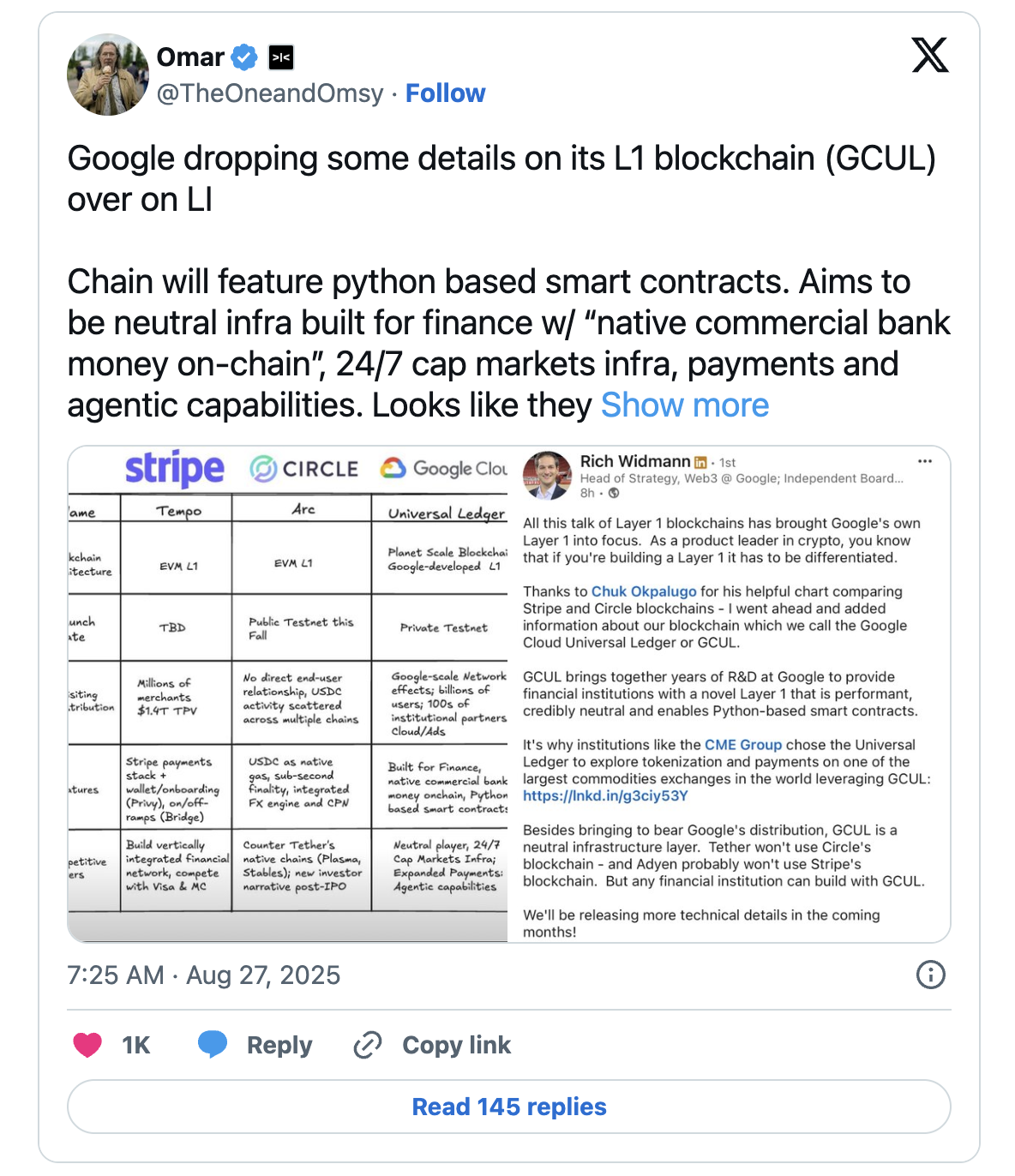

Rich Widmann, global head of strategy for Web3 at Google Cloud, confirmed the positioning in a LinkedIn post on Tuesday.

GCUL aims to serve multiple banks and partners, not just a single corporate network

He described GCUL as a “neutral” infrastructure layer and compared it to projects like Circle and Stripe, creating a chart originally compiled by Paxos product lead Chuk Okpalugo to compare institutional blockchain projects.

Widmann emphasized that GCUL aims to differentiate itself from other enterprise blockchains. Stripe is currently developing its own Ethereum-compatible blockchain, Tempo, focused on efficient payments. Meanwhile, Circle is building Arc to deepen the utility of its USDC stablecoin.

In contrast, Weidman said Google wants to build GCUL into a common foundation for financial institutions rather than a vertically integrated product stack.

Google expands from managed blockchain to build its own protocol using GCUL

Google’s efforts in the blockchain sector reflect its extensive deployment in the digital asset sector. Previously, the company partnered with Coinbase on cloud payments, invested in Web3 startups, and provided infrastructure for public chains including Solana.

With GCUL, Google has signaled its intention to move beyond hosting and into protocol development.

Some observers have questioned whether Google can credibly claim neutrality while operating its own ledger. Users on X noted that decentralization remains an open question for blockchains built and operated by tech companies.

Widmann responded that GCUL is designed so that “any financial institution can use it,” noting that competitors such as Tether will not use Circle’s chain, while payment processors such as Adyen will likely shun Stripe.

CME Group pilot program seen as early endorsement of Google’s blockchain push

The project is still in its early stages. More technical details are expected to be released in the coming months.

Widman also hinted that companies like Amazon or Microsoft could eventually become directly involved. He said the long-term goal is to allow outside companies to operate GCUL independently to serve customers more efficiently.

For Google, the universal ledger represents its effort to play a neutral role in global finance. Meanwhile, asset tokenization is booming. Blockchain-based settlements are attracting the attention of major banks, funds, and corporations, undoubtedly adding urgency to Google’s efforts.

The CME Group’s decision to pilot payments on the system is seen as an early validation of the approach.

The private testnet phase marks the beginning of one of Google’s most ambitious blockchain initiatives.