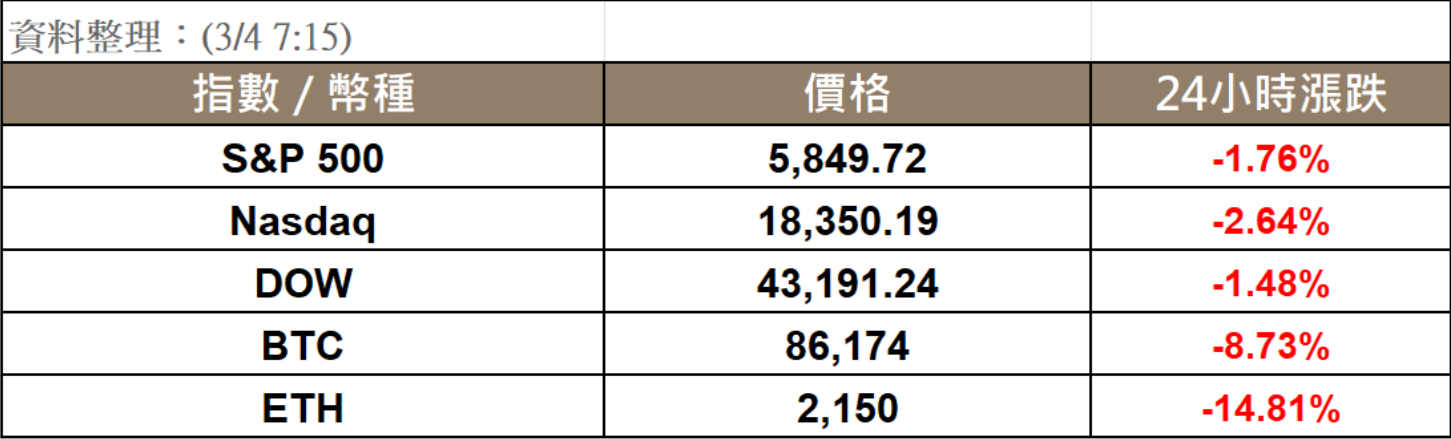

On Monday, former U.S. President Donald Trump reaffirmed that the 25% tariffs on Mexico and Canada would take effect on March 4, with no room for negotiation. This triggered a broad market selloff, causing the three major U.S. stock indices to plunge.

Bitcoin (BTC) crashed from $93K to $86,174, fully retracing its pre-Trump rally gains. Ethereum (ETH) also plummeted nearly 15%, dropping to around $2,150. Over the past 24 hours, the total liquidations across the crypto market reached $810 million.

Tariffs Implemented as Planned—Markets Plummet

Donald Trump officially imposed tariffs on major trade partners, declaring that Mexico and Canada had failed to negotiate for a delay. Additionally, he doubled the tariff rate on China to 20%, fueling concerns about a global economic slowdown.

As a result, U.S. stocks experienced their largest drop of the year:

- S&P 500: ▼ 1.76%

- Nasdaq: ▼ 2.64%

- Dow Jones: ▼ 1.48%

- “Magnificent 7” Tech Index: ▼ 3.1%

NVIDIA (NVDA) plunged nearly 9%, closing at $114.06 per share, bringing its market cap below $3 trillion.

Meanwhile, TSMC ADR (TSM) dropped over 4% to $172.97 per share. Earlier on Monday, Trump met with TSMC Chairman Mark Liu, announcing that TSMC will invest $100 billion in the U.S. over the next four years to build advanced semiconductor fabs.

Bitcoin Falls Back to $86K—$810M Liquidated Across Crypto Markets

The crypto market once again behaved like a risk asset, plunging alongside stocks.

On Sunday, Trump announced that BTC, ETH, SOL, XRP, and ADA would be included in the U.S. crypto reserve, briefly boosting market sentiment. However, within a single day, momentum reversed sharply.

- Bitcoin (BTC) fell from $93K to $86,174, fully wiping out Trump’s pump.

- Ethereum (ETH) plunged nearly 15%, dropping to $2,150.

- All top-10 cryptocurrencies posted losses.

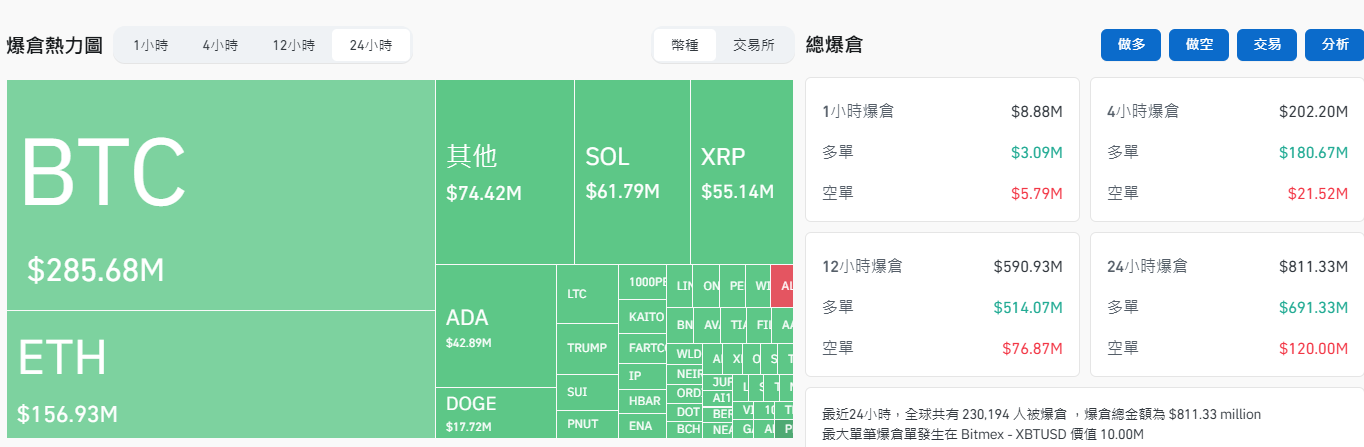

According to Coinglass, the past 24 hours saw $810 million in total liquidations, with:

- Bitcoin (BTC): $286M liquidated

- Ethereum (ETH): $157M liquidated

- Trump-endorsed tokens (ADA, SOL, XRP) suffered heavy losses as well.